What is CDRP? CDRP = Cash Discount Retirement Program.

CDRP

Cash Discount

Retirement Program

Imagine Mr. Merchant that every time Your Customer pays with a Debit or Credit Card; they are funding your Retirement Plan, with No additional Cost from your pocket! Using our Patient Pending Cash Discount Retirement Program (CDRP) we eliminate your 2% merchant processing fees. Then we apply the 2% that you were spending and put it towards your CDRP Retirement Plan. We instead pass on the fee to the customer when they use their credit/debit card and if they pay cash, they receive a cash discount. Like a Cash Price and a Credit Price at the Gas Station. But Now Your Retirement is funded with every card transaction that is made.

Example:

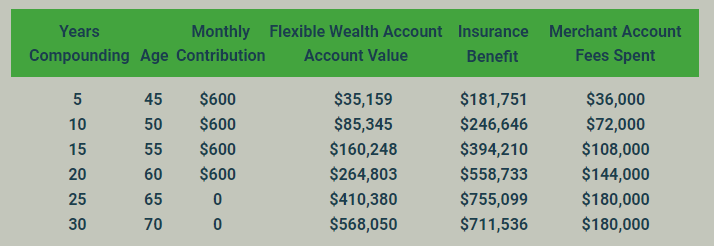

If a Small Merchant process about $30,000 a month in Debit and Credit Cards they would normally be spending about 2% or around $600 a month in merchant fees. If we saved them $600 a month and applied it to their retirement program using an Indexed Universal Life Policy, that normally pays around 10% to 12% return taxed deferred. This would accumulate a very healthy nest egg.

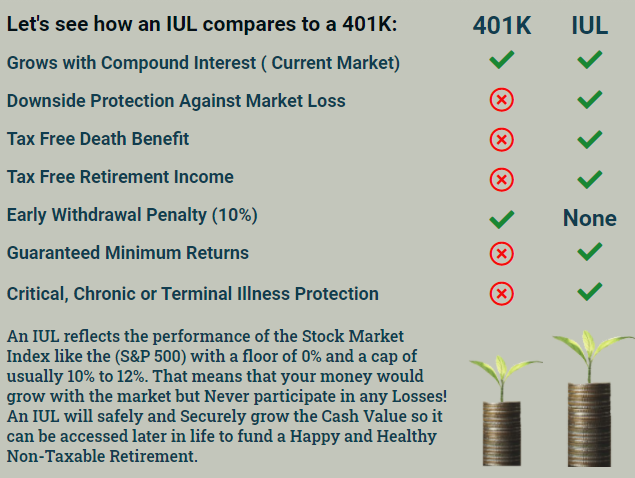

Index Universal Life (I.U.L.) has many advantages over a 401K and here are just a few:

Let's see how an IUL compares to a 401K:

Grows with Compound Interest ( Current Market)

Early Withdrawal Penalty (10%)

Downside Protection Against Market Loss

Tax Free Death Benefit

Tax Free Retirement Income

Guaranteed Minimum Returns

An IUL reflects the performance of the Stock Market Index like the (S&P 500) with a floor of 0% and a cap of usually 10% to 12%. That means that your money would grow with the market but Never participate in any Losses! An IUL will safely and Securely grow the Cash Value so it can be accessed later in life to fund a Happy and Healthy Non-Taxable Retirement.

401K

CDRP IUL

None

CMS Business Advisor helps merchants work smarter not harder. We explain how CDRP can accelerate their retirement.

CMS Business Advisor helps merchants work smarter not harder. We explain how CDRP can accelerate their retirement.

Indexed Universal Life Insurance Provides many unique benefits to the Merchant. Here are a few.

An IUL reflects the performance of the Stock Market Index like the (S&P 500) with a floor of 0% and a cap of usually 10% to 12%. That means that your money would grow with the market but Never participate in any Losses! The IUL will safely and securely grow the Cash Value so it can be accessed later in life to fund a Happy and Healthy Non-Taxable Retirement.

Example: Small Merchant process about $30,000 a month in Debit and Credit Cards Processing. The merchant services fees around 2% or $600.00 a month. An Illustration on a 40-year-old Merchant.

CDRP VS Current Merchant Account Expenditures

Compounding

Age

Contribution

Account Value

Fees Spent

The Choice is clear, the Merchant can choose to start a CDRP program and

Accumulate $568,050

for his Retirement years

or do nothing and spend $180,000

Are you building enough wealth for your retirement?

3 OUT OF 4 ENTREPRENEURS ARE NOT BUILDING ENOUGH WEALTH FOR THEIR RETIREMENT!